Bank accounts for kids: what, when and how

Firstly, may your boots stay warm, and the powder be light and plentiful.

As you may remember, we had ascertained that one of the three piggy banks – “Save” – is destined for long-term savings.

As such, there will come a time when that piggy’s contents will need to be brought to a bank.

If we introduce piggy banks to children around five or six years old, a bank account should be opened about a year later.

If you start the process later, you can shorten the period between 1) learning to save/spend/charity split their income and 2) learning about bank accounts and interest. Nonetheless, always leave some lag time in between to truly instill splitting the income first.

Take a trip to your bank with your child. Most banks have accounts for children that attach to yours with no fees up to a certain maximum balance.

Bring your child’s birth certificate or passport when you go together to open the account. Make sure the bank representative explains how the interest rate works on his/her money and that your child listens to this part.

Your child is there to achieve the following:

- See THE BANK as a physical representation of a big institution that takes care of money;

- Understand what a bank account is;

- Get the first teachings of interest and how it works;

- Nothing else.

NB: Have the rep talk about interest rates at the beginning while it’s all still new and interesting to your kids. The rest of the account opening process is optional for them.

Follow up with your child’s account online or with their statements every month, and let them see how interest affects their accounts.

Tune in next month for the first of a three-part spring series tapping into strategies for buying in bulk, sales shopping, calculating sales tax and so much more!!! They’re gonna love it!

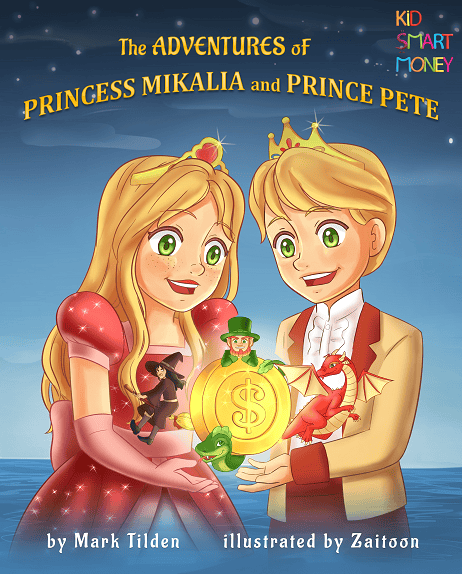

By the same author: Getting interested in interest rates (Click the image below)

Mark Tilden22 Posts

Parti du constat qu’il n’existait aucun matériel pédagogique pour donner aux enfants de bonnes habitudes avec l’argent, Mark Tilden incorpore les bases de la finance adaptées aux enfants de 5 à 8 ans dans de courtes histoires qu’il teste d’abord sur sa fille de 5 ans. Il a ainsi écrit les premières histoires pour enfants de fiction financière fantaisiste au monde. Chaque mois, Mark propose dans sa chronique des activités interactives, simples, et comme il dit… amusantes. Après 18 années de Conseils en placement, Mark Tilden crée kidsmartmoney, une plateforme d’alphabétisation à la finance destinée aux enfants de 5 à 17 ans. Based on the fact that there wasn’t any teaching manual to give children good habits with money, Mark Tilden incorporates financial basics for younger children (5 -8) into bedtime stories he told first his five years old daughter, and he penned most likely the world’s first financial fantasy fiction stories for children. Every month, in his column, Mark will pass on some age appropriate ideas/activities that are interactive, uncomplicated, and dare he say…fun! Investment advisor during 18 years, Mark Tilden create recently kidsmartmoney, a Financial Literacy Education Platform for children from age 5 to 17.

0 Comments