The next step

Okay, so now that our little 10-11-12-13-yearold has a job, or made a job, and created some regular income, what’s next? Reinforce, and re-invent the three-piggy system (Save, Spend, Charity), building on it. Now that they’re getting a little older, at some point they may want to shift from piggy banks to something a little “older”.

If not, no need to rock the boat. Spending money can simply be kept in wallets or purses if they prefer. Piggy banks can be replaced with jars or some other receptacles that are maybe a little more personalized. Setting up one or two more bank accounts to keep these three elements separate is a good idea, as well, so that they get used to separating pay cheques as they come in.

As your child quickly becomes more computer literate than you are, it’s a good time to set them up with an online connection to their bank account, where they can see changes in their income, and the interest it makes. After seeing it in their accounts or on their statements, they will start to get a feel for what interest is and how it works.

From there it’s only a matter of time until they will realize that interest on a bank account doesn’t really grow very much. The perfect intro to investments! Now that they have an interest in interest (pun intended!), it’s suddenly fun to find out that there is a whole slew of things that pay more interest than a bank account! I would start with guaranteed products that pay interest rates, such as bonds, GICs and Treasury bills.

Now, I realize not every parent is going to feel comfortable teaching their kids about investments. There are alternatives. Tune in next month, and we’ll flesh them out a little more.

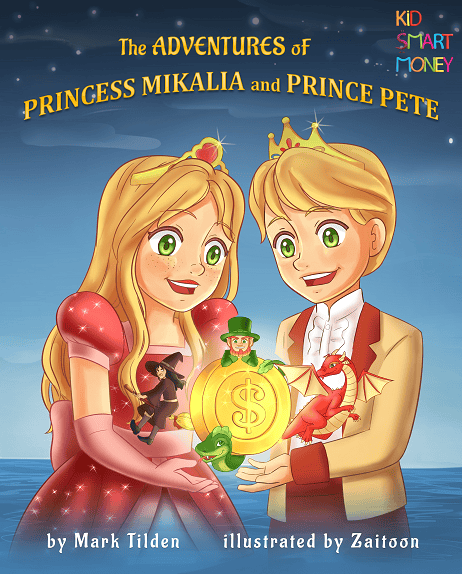

By the thame author: Teaching financial literacy (Click the image below)

Mark Tilden22 Posts

Parti du constat qu’il n’existait aucun matériel pédagogique pour donner aux enfants de bonnes habitudes avec l’argent, Mark Tilden incorpore les bases de la finance adaptées aux enfants de 5 à 8 ans dans de courtes histoires qu’il teste d’abord sur sa fille de 5 ans. Il a ainsi écrit les premières histoires pour enfants de fiction financière fantaisiste au monde. Chaque mois, Mark propose dans sa chronique des activités interactives, simples, et comme il dit… amusantes. Après 18 années de Conseils en placement, Mark Tilden crée kidsmartmoney, une plateforme d’alphabétisation à la finance destinée aux enfants de 5 à 17 ans. Based on the fact that there wasn’t any teaching manual to give children good habits with money, Mark Tilden incorporates financial basics for younger children (5 -8) into bedtime stories he told first his five years old daughter, and he penned most likely the world’s first financial fantasy fiction stories for children. Every month, in his column, Mark will pass on some age appropriate ideas/activities that are interactive, uncomplicated, and dare he say…fun! Investment advisor during 18 years, Mark Tilden create recently kidsmartmoney, a Financial Literacy Education Platform for children from age 5 to 17.

0 Comments