Getting interested in interest rates

I’m a naughty writer. I promised sales and bulk shopping strategies, but my heart wants to follow-up on last month’s bank account and interest intro. If you were looking forward to the shopping strategies, please contact me at any of the coordinates below, and I’ll be happy to go through them.

The initial interest explanation by the bank rep will be forgotten in a heartbeat. So, we the parents, must follow-up. Until children become more proficient at percentages (10-11 ish), the important message to get across is that money in the account earns money on itself (interest).

A great activity to give kids an easy, tactile, visual aid is the marbles in a bowl game:

- Give each kid (or yourself and your child) a few marbles,

- Start with a glass bowl filled with a few marbles (let’s say 5).

- Tell the child(ren) that the marbles in the bowl represent money they deposited in the bank

- Pass the bowl around in a circle (or back and forth between you)

- Each time a new person takes the bowl they put a marble in the bowl to represent a year of interest

From there, it’s an easy jump to show how another deposit will increase their interest payments:

- Add 5 more marbles to the bowl and tell them they’re making another deposit

- Pass the bowl around again, only this time put two marbles in every time it gets passed to a new person; one for each deposit.

- Encourage discussion

Clearly this isn’t a representative example of how much interest (RATE) is actually paid on a real bank account, but it is an excellent kid-friendly way to understand what INTEREST is and how it works.

Next month: The transition to understanding interest RATES

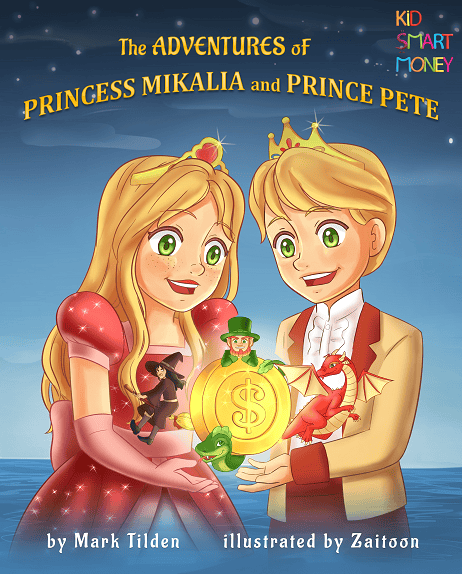

By the same author: KidSmartMoney (Click the image below)

Mark Tilden22 Posts

Parti du constat qu’il n’existait aucun matériel pédagogique pour donner aux enfants de bonnes habitudes avec l’argent, Mark Tilden incorpore les bases de la finance adaptées aux enfants de 5 à 8 ans dans de courtes histoires qu’il teste d’abord sur sa fille de 5 ans. Il a ainsi écrit les premières histoires pour enfants de fiction financière fantaisiste au monde. Chaque mois, Mark propose dans sa chronique des activités interactives, simples, et comme il dit… amusantes. Après 18 années de Conseils en placement, Mark Tilden crée kidsmartmoney, une plateforme d’alphabétisation à la finance destinée aux enfants de 5 à 17 ans. Based on the fact that there wasn’t any teaching manual to give children good habits with money, Mark Tilden incorporates financial basics for younger children (5 -8) into bedtime stories he told first his five years old daughter, and he penned most likely the world’s first financial fantasy fiction stories for children. Every month, in his column, Mark will pass on some age appropriate ideas/activities that are interactive, uncomplicated, and dare he say…fun! Investment advisor during 18 years, Mark Tilden create recently kidsmartmoney, a Financial Literacy Education Platform for children from age 5 to 17.

0 Comments