Financial education in the time of social distancing

I sincerely hope that all of you are safe, healthy and as happy as can be expected during these unprecedented times.

I must admit, I have been finding it difficult to focus on this piece. Then I started thinking about how it’s hard to focus because of all the things we can’t do because of the big “C”. Then it dawned on me: “That’s the story”.

Let’s talk about the simple act of handling money. It’s such a fundamental part of teaching children how to manage money well, that it’s a hard issue to avoid.

Nothing gets touched by more people’s hands than money. It seems like something I’d want to avoid encouraging my child to handle right now.

So, what to do about giving them an allowance?

I now give my daughter an IOU for her allowance. As you can imagine, that’s a big hit! We get by with buying what she wants more often than I normally would, using my card (which no one else touches), and the difference accumulates in IOUs in her piggy bank.

My child is 11, and I’m not sure I want her to have control of her own bank card yet. Clearly, if you have a child that’s a little older, or you feel okay with it earlier, then you can encourage them to use their bank cards.

Important Note: Normally, I would advise against them using a card, as it encourages children not to think about the price of things as much.

Using the same plastic card to pay for everything doesn’t have the same psychological impact as seeing the money being handed over and knowing exactly how much just left your pockets. However, we must adapt…to all of life’s current limitations.

Stay safe, smart, healthy and happy. See you next month.

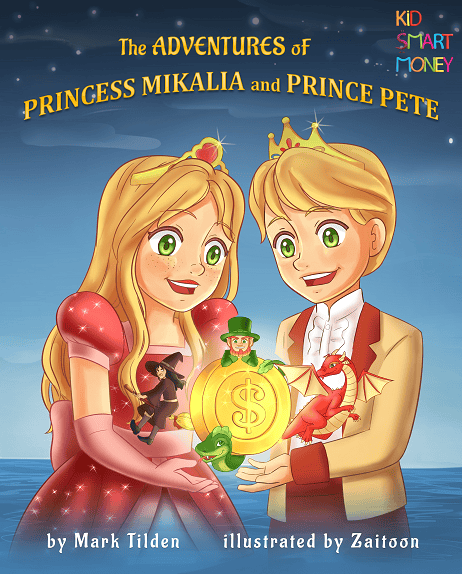

By the same author: The first job (Click the image below)

Mark Tilden22 Posts

Parti du constat qu’il n’existait aucun matériel pédagogique pour donner aux enfants de bonnes habitudes avec l’argent, Mark Tilden incorpore les bases de la finance adaptées aux enfants de 5 à 8 ans dans de courtes histoires qu’il teste d’abord sur sa fille de 5 ans. Il a ainsi écrit les premières histoires pour enfants de fiction financière fantaisiste au monde. Chaque mois, Mark propose dans sa chronique des activités interactives, simples, et comme il dit… amusantes. Après 18 années de Conseils en placement, Mark Tilden crée kidsmartmoney, une plateforme d’alphabétisation à la finance destinée aux enfants de 5 à 17 ans. Based on the fact that there wasn’t any teaching manual to give children good habits with money, Mark Tilden incorporates financial basics for younger children (5 -8) into bedtime stories he told first his five years old daughter, and he penned most likely the world’s first financial fantasy fiction stories for children. Every month, in his column, Mark will pass on some age appropriate ideas/activities that are interactive, uncomplicated, and dare he say…fun! Investment advisor during 18 years, Mark Tilden create recently kidsmartmoney, a Financial Literacy Education Platform for children from age 5 to 17.

0 Comments