Three-piggy system: the new “Eat, Pray, Love”

The “3- piggy system” is basically cute kid-speak for: “Save, Spend, Charity”.

Basically, instead of their allowance and all other income they may receive going into a piggy bank, it gets split between three: one for saving, one for spending, and one for charity.

Your mission, if you choose to accept it, is to explain each category when you first give them the piggy banks, as well as a little guidance as to how much to put in each. That’s it! No deep educational abilities needed, Mom and Dad.

I suggest about 10% into charity, and the largest percentage to go into spending, but percentages are flexible. It’s also important to give them some discretion in how to split it up, so they remain actively involved in making decisions about their money.

It’s a pretty big deal in little lives, and they’re usually pretty eager to learn how to manage their own money… like the cute little knowledge sponges they are! By actively splitting up their allowance every week, they make putting money aside for savings more habitual. The repetition creates the habit.

Full disclosure: most literature suggests presenting “saving” as part of a goal-setting strategy to buy something in the future, like a bike or a video game. Although goal-setting is an excellent lesson, it’s not the right one to teach “savings”.

As an investment advisor for almost two decades, and a dad, I believe the best way to help develop the habit of savings is to teach long-term savings rather than short-term.

I found a particularly fun way to describe long-term savings to my daughter that will also help her develop a fundamental knowledge of the rare and elusive concept of appreciating assets… in kid-speak of course!

How exactly? Why exactly? Tune in next issue!

#kidsmartmoney #financialliterature #childeducation

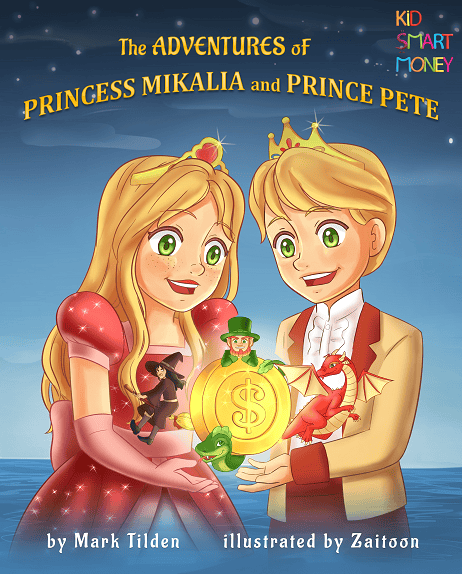

By the same author: Learning to save means learning to save long-term (Click the image below)

Mark Tilden22 Posts

Parti du constat qu’il n’existait aucun matériel pédagogique pour donner aux enfants de bonnes habitudes avec l’argent, Mark Tilden incorpore les bases de la finance adaptées aux enfants de 5 à 8 ans dans de courtes histoires qu’il teste d’abord sur sa fille de 5 ans. Il a ainsi écrit les premières histoires pour enfants de fiction financière fantaisiste au monde. Chaque mois, Mark propose dans sa chronique des activités interactives, simples, et comme il dit… amusantes. Après 18 années de Conseils en placement, Mark Tilden crée kidsmartmoney, une plateforme d’alphabétisation à la finance destinée aux enfants de 5 à 17 ans. Based on the fact that there wasn’t any teaching manual to give children good habits with money, Mark Tilden incorporates financial basics for younger children (5 -8) into bedtime stories he told first his five years old daughter, and he penned most likely the world’s first financial fantasy fiction stories for children. Every month, in his column, Mark will pass on some age appropriate ideas/activities that are interactive, uncomplicated, and dare he say…fun! Investment advisor during 18 years, Mark Tilden create recently kidsmartmoney, a Financial Literacy Education Platform for children from age 5 to 17.

0 Comments