The New Year’s resolution to change your kid’s life

Looking for a New Year’s resolution that’s easy, fulfilling, and will change your kids lives forever?

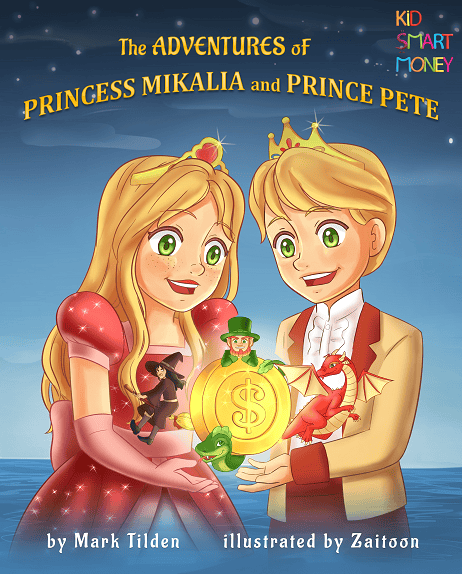

Tell them about… the “Magical Things”: the few things in life that usually go up in value instead of down. What are they? How do I present them to my child so it doesn’t seem like totally boring old person stuff?

They are: real estate; precious metals, art and Investments.

Every child is different, right? So the approach needs to vary a little as well. Start with basics like age and gender, then throw in his/her personality and let your imagination flow.

- Most six- year-old girls like princesses. Princess need a palace (real estate) to be magnificent in and saving can make that happen (and investing, when she’s a little older).

- What princess – or any woman, really – would feel complete and fabulous without jewellery (precious metals)?

- A young boy may be more impressed by owning his own mansion (real estate) like Batman.

- Perhaps an island (real estate) to fight crime from, like teen Titans, is more appealing.

- Enterprising boys or girls may be attracted to the appeal of being a boss who makes big important decisions, and buys and sells stuff (investments).

Your imagination is the limit. You cannot fail. The idea isn’t to teach them about accruing assets in detail, we just want to instill a base knowledge of the fact that while most things go down in value after we buy them, these few “magical things” usually go up.

It may seem a small thing, but this little tidbit is more than most of us ever knew at their age, and is part of the pre-financial ABCs and 1,2,3s that will make financial literacy in primary and secondary levels as natural as literature and math.

Next month: Bank accounts. When? How? What should you know?

By the same author: Bank accounts for kids: what, when and how (Click the image below)

Mark Tilden22 Posts

Parti du constat qu’il n’existait aucun matériel pédagogique pour donner aux enfants de bonnes habitudes avec l’argent, Mark Tilden incorpore les bases de la finance adaptées aux enfants de 5 à 8 ans dans de courtes histoires qu’il teste d’abord sur sa fille de 5 ans. Il a ainsi écrit les premières histoires pour enfants de fiction financière fantaisiste au monde. Chaque mois, Mark propose dans sa chronique des activités interactives, simples, et comme il dit… amusantes. Après 18 années de Conseils en placement, Mark Tilden crée kidsmartmoney, une plateforme d’alphabétisation à la finance destinée aux enfants de 5 à 17 ans. Based on the fact that there wasn’t any teaching manual to give children good habits with money, Mark Tilden incorporates financial basics for younger children (5 -8) into bedtime stories he told first his five years old daughter, and he penned most likely the world’s first financial fantasy fiction stories for children. Every month, in his column, Mark will pass on some age appropriate ideas/activities that are interactive, uncomplicated, and dare he say…fun! Investment advisor during 18 years, Mark Tilden create recently kidsmartmoney, a Financial Literacy Education Platform for children from age 5 to 17.

0 Comments