KidSmartMoney

My father, a good man and good provider, spent his entire working career in the financial field yet never taught us anything about managing money. Oddly, this isn’t a unique story. For some reason it’s been taboo in our society to talk about finances. Well it’s time to taboo that taboo, folks!

Financial concepts should not be learned on the fly, at the mercy of money lenders who understand the system that we don’t. Our children deserve to have the benefit of an education that will impact the biggest decisions of their lives.

Managing money is a fundamental social skill that virtually every single human being on earth will have to perform at some point in their lives. The decisions they make using this skill will impact their lives more than anything else. It’s mind-boggling to me that it’s not a core subject in every primary and secondary school.

This column will explore how to make up for that missing school link. Every month I will pass on some age-appropriate ideas/activities that are interactive, uncomplicated, and – dare I say – fun!

This isn’t high finance folks. We’re talking about rudimentary basics that create the habits for learning. Even if you don’t know the first thing about money management or finances, you can be the influence that change requires. Think about it. Are you a language expert? Yet, you taught your offspring their first language. Are you a mathematician? Yet, you taught your child or children to count.

Now that I’ve used up all my space introducing myself and the column, let’s see if we can make an initial suggestion. It’s back to school time; that means shopping. Do we take the kids with us, or shop in peace without the kids constantly asking to buy this, that, and the other thing, throwing things in the basket behind our back, etc.?

Bring them with you, but with a plan. There is no better school than real life! Make them an active part of the process. Give them a few items on your shopping list and a specific budget. Tell them to find the items on the list based on your shopping criteria (i.e., the cheapest, a specific brand, bulk, etc.). You choose the criteria based on your values.

By giving them an activity with specific parameters, you give them responsibility and choice in their lives, to which children react extremely well. You are also passing on your values while creating a teachable moment that also instills order to shopping with children (and peace of mind for you!)

Next month we will start a three-part series about allowances. Yes or no? What are they going to learn? How much?

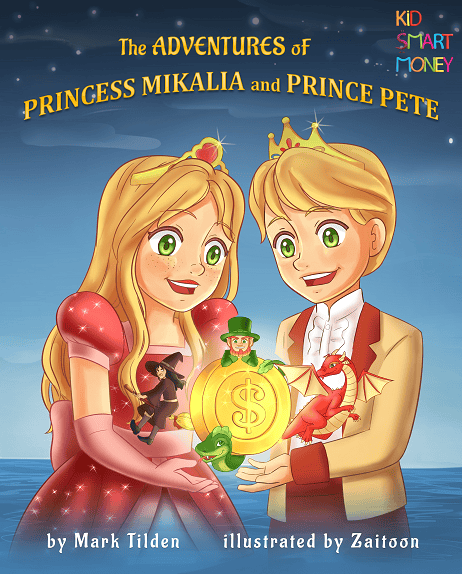

By the same author: Allowance or no allowance? That is the question (click the image below)

Mark Tilden22 Posts

Parti du constat qu’il n’existait aucun matériel pédagogique pour donner aux enfants de bonnes habitudes avec l’argent, Mark Tilden incorpore les bases de la finance adaptées aux enfants de 5 à 8 ans dans de courtes histoires qu’il teste d’abord sur sa fille de 5 ans. Il a ainsi écrit les premières histoires pour enfants de fiction financière fantaisiste au monde. Chaque mois, Mark propose dans sa chronique des activités interactives, simples, et comme il dit… amusantes. Après 18 années de Conseils en placement, Mark Tilden crée kidsmartmoney, une plateforme d’alphabétisation à la finance destinée aux enfants de 5 à 17 ans. Based on the fact that there wasn’t any teaching manual to give children good habits with money, Mark Tilden incorporates financial basics for younger children (5 -8) into bedtime stories he told first his five years old daughter, and he penned most likely the world’s first financial fantasy fiction stories for children. Every month, in his column, Mark will pass on some age appropriate ideas/activities that are interactive, uncomplicated, and dare he say…fun! Investment advisor during 18 years, Mark Tilden create recently kidsmartmoney, a Financial Literacy Education Platform for children from age 5 to 17.

0 Comments